🚂Hype Train #49: Superstonk

Take care out there guys

🚂 All aboard! Following on from last week, here’s some free alpha: this Reddit post explains the top 50 cryptocurrencies with one sentence for each. Do with it what you will.

In today’s edition:

💡 The Rundown

🔮 Stock analysis from around the web

Let’s not get too lost in the sauce

⭐Pick a stock: Remember if you forward this on to a mate and let us know, we’ll provide an overview of any ASX stock of your choosing in an upcoming edition.

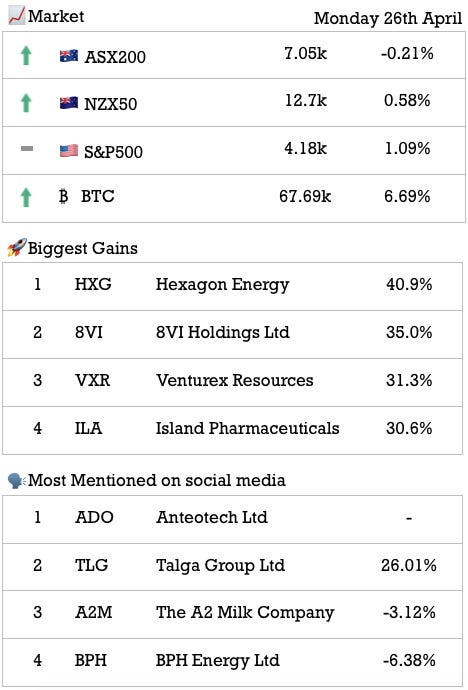

Markets

Sources: Google Finance, HotCopper, asxbot.io

Biggest gainer: Hexagon Energy (ASX: HXG) rocketed 40.9% today following a quarterly activities report and its recent acquisition of Ebony Energy.

The CEO believes the acquisition will bolster their clean energy focus by being a regionally important hydrogen producer

Most gossiped: Anteotech (ASX: ADO) was the most mentioned across the socials today. This is on the back of (1) a successful performance test leading to commercialisation talks and (2) going into a trading halt to raise $ from investors.

⭐ We’ve upgraded our most mentioned score. It’s now determined based on multiple social platforms.

The Rundown

💡

Back to the future: Tech inventor, Hunter Kowald, has been flying through LA streets on his hoverboard, which has been announced as ready for production.

Unicorn status: Exciting card issuing and payment processing fintech Marqeta, has stated its intentions of starting up in Melbourne, as it seeks a $US10b IPO this year.

For those that love coffee: Rewardle (ASX: RXH) is upgrading the Beanhunter crowd-sourced coffee review website in exchange for fees of $5k per month and the option to acquire 51% of their business within 3 years at a $350k valuation.

Google Argentina acquired for 2 euros? During a crash last week, Google Argentina’s domain was acquired by a web designer… for a total price of 2 euros.

“It feels like a dream”: Musk relieved, as SpaceX successfully launched a team of astronauts to the International Space Station, marking the third human spaceflight in less than a year.

Web Stock Analysis

🔮

A2M Milk: This Redditor believes A2 Milk (ASX: A2M) has lots of potential, however even at a 4-year low, it may be pricing in unrealistic growth

More than just candles: Some Reddit due diligence into Dusk (ASX: DSK)

First ever DD: A look into Lachlan Star Resources (ASX: LSA)

Priced in? This Twitter user thinks Ethereum’s upgrade may see it’s sell pressure drop 90% (the equivalent of 3 Bitcoin halving events) in the next 12 months

Opinion piece

😂

TLDR: r/Superstonk has grown rapidly to 229k members, and seems to be the epitome of a meme stock echo chamber. Always make your own decisions instead of blindly following the crowd.

Let's not get lost in the sauce

Somehow despite writing a newsletter that is partly fueled by the Reddit community, it was only today that I discovered the subreddit r/Superstonk.

This is essentially r/wallstreetbets on steroids…

If you take a look at this sub, it seems to confirm what I have been feeling for a while now. This is the increasingly overzealous attitude towards investing that has been brought about by the surge in retail investment over the last year. While it is great that people I talk to who were never interested in investing have started to look beyond bank accounts to house their savings, I have concerningly seen people completely skip over more traditional investments in favour of things like riding the dogecoin wave.

Let me preface this by saying that I wish nothing but success for these people jumping on bandwagon pumps like dogecoin and GME. However, I think there is a dangerous attitude that is being echo chambered in these communities; that if enough people collectively pump certain investments, everyone can get off with huge profits.

The main issue with this the sentiment I see almost everywhere now is that the entire preface for investing in an asset is based on a wholly backwards-looking analysis. Certain brokers don’t advertise stocks on the basis of their fundamentals or great management team, they show you how much money you have already missed out on. This is consistent across a huge number of communities and I think people need to remember that just because a stock has shot up 1000% over the last year, doesn't mean it will keep doing it forever.

Sure, some people do come up with detailed bull cases, but more often than not these are more wild speculation to confirm their existing bias rather than actual research. r/superstonk is what I consider to be the amalgamation of this kind of crystal ball gazing disguised as research, and the sheer amount of engagement here is concerning to me.

At the end of the day someone will be left holding the bag, and I hope it's not you. Learn to make your own decisions instead of blindly following the crowd. As I said earlier, the crowd isn’t always wrong, and if you genuinely think Dogecoin is a good bet, got for it. But put some thought in first. Take care out there guys.

📧 Did someone forward you this email?

Sign up here, it’s free.

Thank you and have a great week.